Does Homeowners Insurance Coverage Cover Flooding? Private flood insurance can assist load the space for those without flood insurance NFIP insurance coverage and deal higher amounts of coverage. Typically, you're covered for water damage that originates inside your home, such as a ruptured pipe, faulty plumbing, or a malfunctioning device. Usually talking, if your home experiences water damage as a result of a protected occasion-- for instance, as a result of a burst pipe or abrupt and unintended discharge-- it will certainly be covered by your plan. Your property owners insurance coverage does not offer protection to your car or other vehicle, also if it's sitting in your driveway or garage. If you can see or smell mold inside your home, you need to take actions to eliminate the cause and clean up and remove the mold and mildew. See how DSI can help provide you or your company the insurance coverage you need. If you reside in a location susceptible to wildfires, there are steps you can require to lower your risk and maintain your home safe. Personal effects insurance coverage against theft undergoes the exact same limitations talked about above. Discover Progressive's editorial criteria for Answers articles to discover why you can trust the insurance policy info you locate right here. Most of the times, if you can see mold, do not throw away the time or cash checking it. Criterion homeowners insurance policy won't cover flooding damage, no matter if it's from tornado surge, heavy rainfalls, or overflow from a nearby body of water. The only means to be secured is with a different flood insurance plan. You might have the ability to purchase a separate flooding insurance coverage to secure your basement against water damage from outdoors flooding. Flood insurance coverage may be important if you reside in an area with a high danger of flooding. Understand that not all flooding insurance plan consist of below-ground-level rooms, so talk to your insurance company to see exactly how you're safeguarded. You can, however, purchase separate flood insurance policy via the National Flood Insurance Policy Program (NFIP) or various other exclusive insurance firms.

Why is flood insurance policy not consisted of in a basic homeowners insurance coverage?

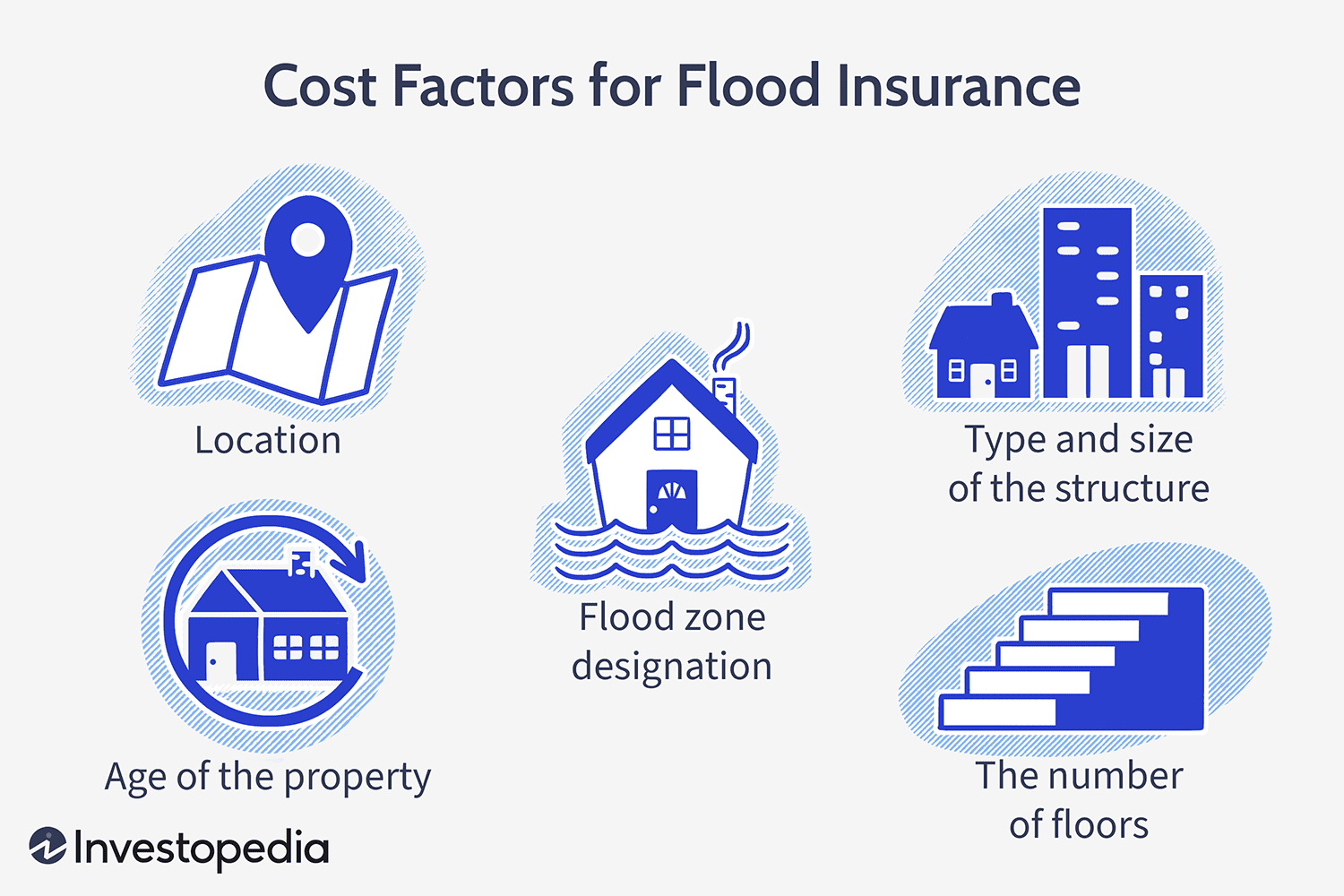

The primary factor flood insurance is not included in standard home insurance policy is the basically different risk assessment. Flooding is a local event that can create substantial damage to homes in specific locations while saving others.

McAllen Storm Damage Lawyer

My Automobile Was Submerged In Flood Water Will The Damages Be Covered By My Auto Policy?

Insurance coverage for basements, crawlspaces and ground-level rooms on elevated homes is limited. If your home has these areas, make certain to ask your insurance coverage agent about any type of restrictions in your protection. Jennifer Gimbel is an elderly handling editor at Policygenius, where she oversees every one of our insurance policy coverage. Previously, she was the managing editor at Finder.com and a content strategist at Babble.com. When rain in your house is left unaddressed for weeks or months, the damages has a chance to become worse and new issues can develop. If a government calamity statement is provided for the flood, you can put on FEMA for disaster aid, whether you have insurance or not. Kara McGinley is a former senior editor and qualified home insurance coverage professional at Policygenius, where she focused on house owners and tenants insurance policy. As a reporter and as an insurance policy expert, her work and insights have been featured in Forbes Advisor, Kiplinger, Lifehacker, MSN, WRAL.com, and somewhere else. But even if your insurance claim was denied doesn't imply you can't appeal the decision. Some insurers do offer a limited flooding endorsement, however this is the exception, not the guideline. But the forget is the first cause for the rain going into and consequently isn't covered Each plan is one-of-a-kind, and your house owners insurer might not pay in all these circumstances. Additionally, your policy may have exclusions that can use even in these situations.Flooding Insurance Policy

- Damage from wind-driven rain that takes a trip into your home through high winds during a storm or hurricane is typically covered by home insurance coverage.Nevertheless, if your roof leaks while it is drizzling, causing damages to your furniture, your insurance claim will likely be refuted if the roof covering is old and shows signs of forget.Homeowners insurance coverage normally covers water damages from rain if it enters your home as a result of a covered peril, like a cyclone.However, this mistaken belief can result in significant financial challenge when swamping strikes, as flooding damage is typically not covered by conventional home owners insurance coverage.